[ad_1]

Infor is a New York-based vendor of ERP and other enterprise business software. It is known for a broad line of dozens of products, many of them older platforms acquired from other companies, and for strong offerings in industry sectors such as food and beverage, process manufacturing, distribution and healthcare.

Since taking on new management in 2010, it has embarked on an aggressive cloud computing strategy to modernize its product portfolio and compete in the top tier of ERP vendors.

Infor history and acquisitions

Founded in 2002 as Agilisys, the company soon started a multiyear buying spree, during which it acquired such ERP vendors as Lilly Software (maker of Visual Manufacturing) MAPICS and Geac. Agilisys changed its name to Infor Global Solutions in 2004, and in a major acquisition two years later, it bought SSA Global Technologies, itself a buyer of numerous ERP brands.

Infor leadership changes and modernization

In 2010, a group of ex-Oracle executives joined Infor senior management, led by CEO Charles Phillips.

Under Phillips’ tenure, Infor sought to modernize its software architecture and update key modules within SyteLine, the manufacturing ERP product it had acquired with MAPICS, and by developing XA, a newer ERP platform combining cloud, mobile, social and data analytics technology that was introduced in 2013. Infor also moved its headquarters from Alpharetta, Ga., to New York’s Silicon Alley district.

Other Infor major acquisitions and expansions

In 2011, Infor made its largest acquisition to date by purchasing Lawson Software for $2 billion. This acquisition significantly bolstered Infor’s presence in the healthcare industry and the public sector.

In 2012, Infor founded an internal software design and development lab called Hook & Loop, which emphasizes the user experience (UX) of software it develops for individual customers and the Infor product line.

In 2014, Infor made a major bet in its cloud strategy by choosing Amazon Web Services (AWS) as the public cloud platform for its software as a service (SaaS) products.

In 2015, Infor expanded its global reach by acquiring GT Nexus, a prominent global e-commerce network. This move helped integrate supply chain and commerce capabilities into Infor’s cloud platform. Two years later, Infor acquired Birst, a maker of business intelligence software, in a continuation of a multiyear process of buying specialized applications and technologies that support its modernization efforts.

By 2017, Infor claimed more than 15,000 employees and 90,000 customers. Most analyst rankings of ERP vendors put it in a virtual tie for third or fourth place with Microsoft, though each has roughly half the share of market leaders SAP and Oracle.

In 2018, Infor introduced industry-specific AI and machine learning applications, continuing its push toward integrating advanced technologies within its ERP solutions. The following year, Infor hosted its first Diversity Tech Summit for technology CEOs and received an additional $1.5 billion investment from Koch Equity Development.

In 2020, Koch Industries acquired the remaining shares of Infor, making it a wholly owned subsidiary. This acquisition aimed to further utilize Infor’s technological advancements within Koch’s diverse portfolio of companies.

As of 2023, Infor remains a leader in cloud ERP, recognized for its complete vision and ability to execute in the Gartner Magic Quadrant for Cloud ERP for Product-Centric Enterprises.

Infor software products

Infor’s history as an acquirer and consolidator of ERP vendors and platforms — several dozen in all — has left it with a huge portfolio of legacy brands to maintain. Notable ERP brands acquired by Infor include Baan, a Dutch ERP vendor and onetime serious rival of SAP, BPCS, Frontstep, Geac, Invensys, Lawson, MAPICS, MaxCim, SSA Global and Visual Manufacturing.

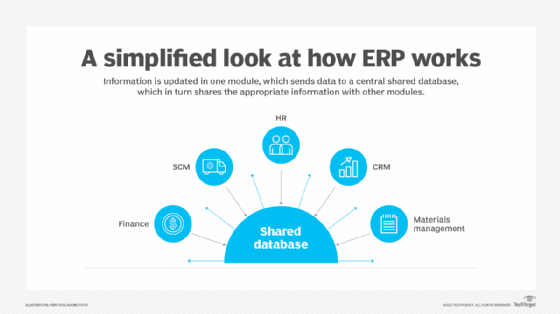

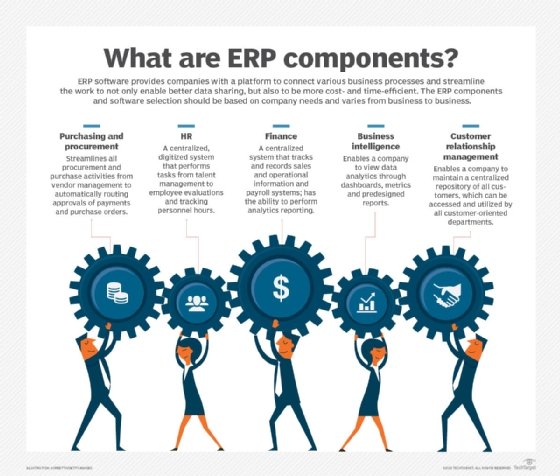

As a result, the company sells or supports several brands of ERP as well as software for related business functions: CRM, financial management, human capital management, performance management, product lifecycle management and supply chain management.

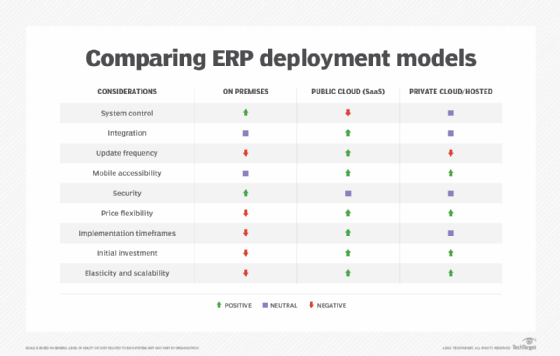

In addition, its enterprise asset management (EAM) software has achieved a leadership position in the fast-growing EAM segment and is often paired with ERP from a different vendor. Many Infor products are available in on-premises, hybrid cloud and SaaS versions.

In addition to MAPICS’ SyteLine, some of the other acquired brands live on in Infor product lines. Infor LN traces its heritage back to Baan, having acquired the name LN from the previous owner and Infor-acquired vendor, SSA. Infor LX is a manufacturing ERP system that SSA had itself acquired from BPCS. Infor M3 is a former Lawson ERP product geared to medium-sized and large companies.

Other products still supported or sold include Infor Visual and Infor XA, the former MAPICS system for discrete manufacturers.

Infor-developed products

Infor has also developed numerous software products of its own, however, including 10x, a social, mobile, analytics and cloud platform for ERP introduced in 2013 that included Ming.le, a social-collaboration tool designed to work across Infor products.

10x also included Intelligent Open Network (ION), a middleware platform that Infor had debuted in 2008. It uses Extensible Markup Language (XML), an independent standard for sharing structured data over the public internet or internal networks. The vendor also offers an application development framework called Mongoose that is designed to allow Infor users to customize or extend their applications.

Like most vendors of legacy, on-premises ERP, Infor has invested billions of dollars in developing SaaS versions of its product line, notably the CloudSuite ERP system, as well as new applications and cross-platform technologies.

In 2014, it released a beefed-up version of 10x called Xi, which added AWS-powered multi-tenant cloud, analytics and mobility features. In 2017, Infor introduced AI technology called Coleman, which is designed to make ERP applications more conversational and helpful through the use of machine learning, voice recognition and predictive analytics.

In 2018, Infor continued its innovation trajectory by introducing AI and machine learning applications tailored for specific industries. These advancements aimed to enhance operational efficiency and decision-making processes across various sectors.

In recent years, Infor has made more significant strides in cloud technology and AI. The company introduced Infor GenAI in 2024, using generative AI to improve productivity, streamline operations and provide real-time insights. This platform includes capabilities for assisted authorship, summarization and digital assistance, designed to enhance user experiences across its CloudSuite solutions.

Infor has also focused on expanding its developer ecosystem. In 2024, the company launched the Infor Developer Program and Developer Portal, providing tools and resources to developers for creating and integrating applications within the Infor ecosystem. This initiative aims to foster innovation and customization, enabling customers to tailor solutions to their specific needs.

Moreover, Infor’s commitment to sustainability and environmental, social and governance (ESG) criteria has led to the development of new features and tools within its product suite. These enhancements support businesses in achieving their sustainability goals and regulatory compliance.

Infor industries

By mid-2017, CloudSuite had expanded to include more than a dozen versions for subindustries within manufacturing, consumer packaged goods, distribution and service sectors. These industry-specific offerings are often developed in collaboration with Infor’s partners and are tailored to meet the unique needs of each industry.

Thanks in part to its years of acquiring ERP brands that specialized in particular vertical industries, Infor has developed expertise in industry business processes that has allowed it to segment its CloudSuite ERP offerings for microverticals.

For example, Cloud Suite Food and Beverage has packages for the baker and brewery microverticals, and there are specialized ERP offerings for building materials; equipment rentals; footwear; furniture and fixtures; electronics; home textiles; insurance; lumber and wood; and shipbuilding, among others.

Get to know the differences between on-premises ERP and cloud ERP, particularly multi-tenant SaaS. Explore the key differences between cloud ERP versus on-premises ERP in 12 important areas.

[ad_2]

Source link